Learning how to calculate your budget is one of the most empowering financial moves you can make. Whether you’re tackling a home renovation project, planning a major purchase, or just trying to get your finances in order, knowing exactly where your money goes is half the battle. In this guide, we’ll walk through five straightforward steps that’ll help you build a budget that actually works for your life—not some cookie-cutter plan that looks good on paper but falls apart in week two.

Table of Contents

Step 1: Track Your Income

Before you can build a solid budget, you need to know what you’re working with. Start by writing down all your income sources. This sounds simple, but most people underestimate what they actually bring in each month.

If you’re salaried, grab your last pay stub and note your after-tax income—that’s the real number that hits your account. If you’re freelance or have variable income, look back at the last three to six months and calculate an average. Don’t include bonuses or tax refunds in your base number; treat those as windfalls when they arrive. Side hustles count too. Got a seasonal income spike? Write it down separately so you can plan for lean months.

The key here is being honest about what you actually receive, not what you wish you made. This foundation determines everything else in your budget.

Step 2: List All Your Expenses

This is where most budgets fail—people forget entire categories of spending. Grab your bank and credit card statements from the last three months and go through them line by line. Write down everything, and I mean everything: rent, utilities, groceries, subscriptions you forgot about, that coffee habit, insurance premiums, car payments, medical expenses, and childcare.

Don’t judge yourself here. The goal isn’t to shame yourself into spending less; it’s to see reality. Many people discover they’re spending $50-100 monthly on subscriptions they never use. Others find streaming services, gym memberships, and app purchases adding up faster than expected.

Break expenses into two buckets: fixed (same amount every month) and variable (fluctuates). Fixed expenses are easier to predict—rent, insurance, loan payments. Variable expenses like groceries, gas, and dining out need averaging based on your recent history.

Step 3: Categorize Your Spending

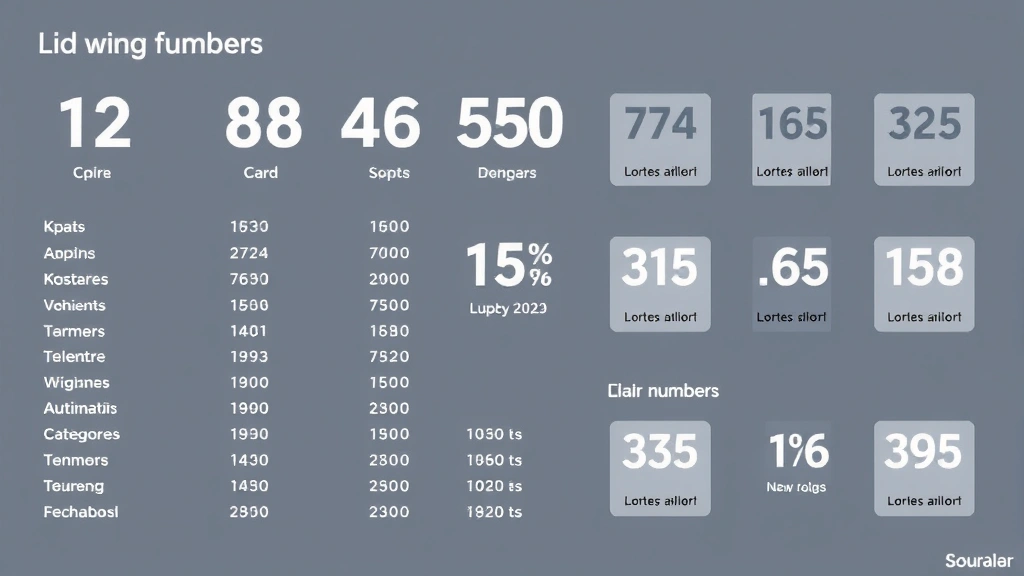

Now organize those expenses into logical categories. Most people find these work well: Housing, Transportation, Food, Utilities, Insurance, Debt Payments, Savings, Entertainment, Personal Care, and Miscellaneous. Some folks add Health & Medical, Childcare, or Pet Care depending on their situation.

This categorization helps you see patterns. Maybe you’re spending way more on dining out than you realized, or your utility bills are higher than they should be. When you see it organized this way, opportunities for adjustment become obvious.

If you’re planning a specific project—like a home repair or car maintenance—create a separate category for that. This is similar to how you’d care for investments over time, tracking their health and growth. Your budget deserves the same attention.

Step 4: Set Realistic Goals

Here’s where your budget becomes a tool instead of a punishment. Look at your income versus your total expenses. Are you spending more than you make? That’s your wake-up call. Are you breaking even? Time to build in savings. Do you have money left over? Great—now decide what to do with it.

Set specific, measurable goals. Instead of “spend less,” try “reduce dining out by 30%” or “save $200 monthly.” If you’re saving for something specific—a vacation, home improvement, emergency fund—put a number on it. This gives your budget purpose.

The 50/30/20 rule is a solid starting point: 50% of after-tax income on needs (housing, food, utilities), 30% on wants (entertainment, dining out), and 20% on savings and debt repayment. But adjust this based on your life. If you live in a high-cost area, housing might be 60%. That’s fine—make it work for you.

Think of this like planning a DIY project budget. You wouldn’t start work without knowing what you need to spend, just as you wouldn’t check your car’s alternator without understanding what could go wrong. Planning ahead prevents costly mistakes.

Step 5: Adjust and Monitor

Your first budget won’t be perfect, and that’s okay. Live with it for a month, then review. What worked? What didn’t? Where did you overspend? Where did you underspend?

Make adjustments based on reality, not theory. If your grocery budget is too tight, increase it. If you budgeted $100 for entertainment but spent $50, you’ve found extra money. Maybe that goes to savings, or maybe you were just being restrictive and should enjoy it.

Set up a system to track spending throughout the month. Use a spreadsheet, budgeting app, or old-school notebook—whatever you’ll actually stick with. Check in weekly, not just at month’s end. This keeps you aware and prevents surprises.

Just like maintaining any system, consistency matters. Similar to how you’d change a key fob battery when needed, you’ll need to update your budget when life changes—new job, moving, family changes, major purchases.

Common Budgeting Mistakes to Avoid

Don’t budget based on what you think you should spend—budget based on what you actually spend. There’s a big difference. Many people underestimate their food costs or forget about irregular expenses like car maintenance, annual insurance premiums, or holiday gifts.

Another mistake: being too rigid. If you budget $100 for dining out but only spend $80, that’s not failure—that’s success. Don’t feel obligated to spend every dollar you’ve allocated. Conversely, if you consistently overspend a category, that’s information telling you your budget needs adjustment.

Don’t forget to budget for fun. A budget that’s all restriction will fail. You need money for entertainment, hobbies, and occasional splurges. Without that, you’ll abandon the budget out of resentment.

Also, many people neglect emergency savings. Even a small amount—$25-50 monthly—builds a cushion for unexpected expenses. This prevents budget derailment when surprises happen.

Tools and Resources

You don’t need fancy software to budget. A spreadsheet works great if you’re comfortable with Excel. Google Sheets is free and cloud-based, so you can access it anywhere. Apps like YNAB (You Need A Budget), Mint, or EveryDollar automate tracking and offer insights.

For authoritative guidance, check out Family Handyman for home project budgeting tips, This Old House for renovation cost planning, and Bob Vila for DIY project estimates. The U.S. government’s MyMoney.gov offers free budgeting resources and calculators.

If you’re budgeting for specific projects, those sites have cost breakdowns that help you plan accurately. Learning to budget for a home repair teaches the same principles as budgeting your overall finances.

Frequently Asked Questions

How often should I review my budget?

Check your budget weekly to stay aware, but do a full review monthly. Quarterly reviews help you spot trends. Adjust your budget when major life changes occur—job changes, moving, family changes, or significant expense increases.

What if my income varies month to month?

Average your income over the last three to six months and budget based on that average. When you earn more than average, put the extra toward savings or debt. When you earn less, you’ve already planned for it.

Should I include savings in my budget?

Absolutely. Treat savings like a bill you must pay. Even $25-50 monthly builds an emergency fund. Once you have three to six months of expenses saved, you can adjust that amount toward other goals.

Can I budget if I have irregular expenses?

Yes. Divide irregular expenses by 12 and include that monthly amount in your budget. For example, if your car insurance is $600 annually, budget $50 monthly. This prevents sticker shock when the bill arrives.

What’s the best budgeting method?

The best method is one you’ll actually follow. Try the 50/30/20 rule, the zero-based budget, or the envelope method. Give each approach a month before deciding. Your budget should match your personality and financial situation, not someone else’s system.

Conclusion

Learning how to calculate your budget isn’t about restriction—it’s about clarity and control. When you know where your money goes, you can make intentional choices instead of wondering where it all disappeared. Start with these five steps: track your income, list your expenses, categorize them, set realistic goals, and monitor progress.

Your budget will evolve as your life changes. That’s normal and healthy. The key is starting, staying consistent, and adjusting when needed. You’ve got this. Build your budget this week, and in a month, you’ll have a clear picture of your financial reality. That’s power.